Home Purchase Mortgage Preapprovals

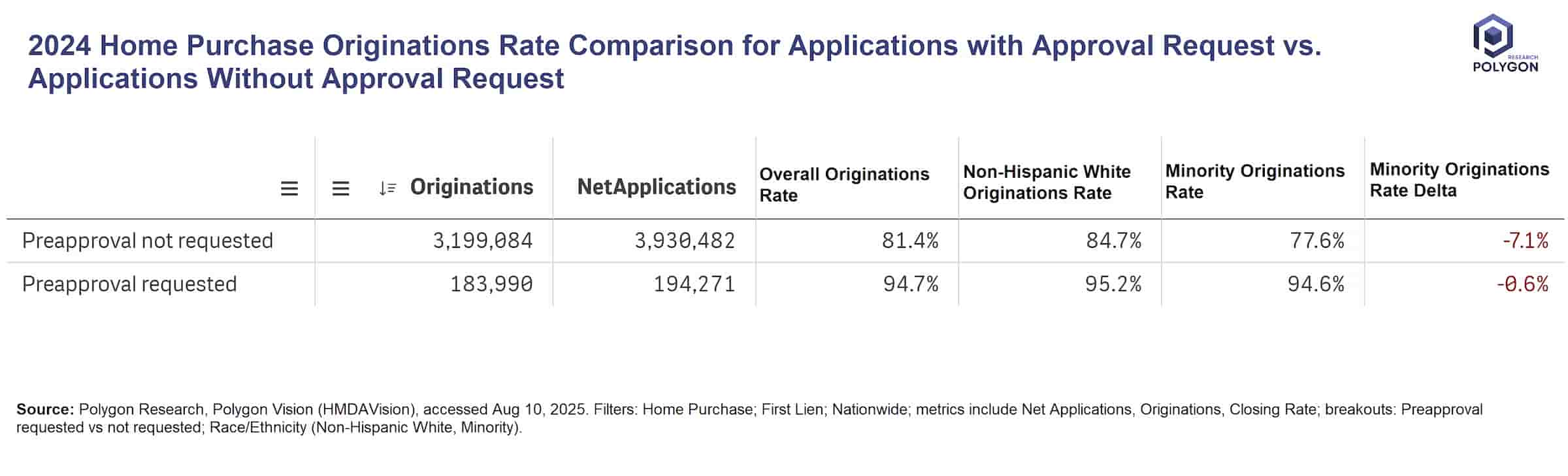

This table from HMDAVision uses 2024 HMDA data to compare home purchase loan origination rates for first-lien applications nationwide, segmented by preapproval request status. It shows two rows:

- Applications without preapproval (3.93M net apps, 3.19M originations, 81.4% overall originations rate) and

- Applications preapproval (194K net apps, 184K originations, 94.7% overall originations rate).

Originations rates are broken out by non-Hispanic white (84.7% vs. 95.2%) and minority borrowers (77.6% vs. 94.6%), with a delta column highlighting gaps (-7.1% vs. -0.6%).

Preapprovals involve full underwriting and are reported in HMDA. For example - verifying income, assets, credit - conditioning only on property/title, unlike prequals using stated info.

Strategically, lenders can deploy preapproval programs to accelerate originations rate, minimize fallout, and empower agents with buyer certainty for faster wins in tight markets. This drives volume growth, optimizes warehouse lines, and fosters better experience for real estate agent partners.

From Analysis to Action

Ready to Continue? Get Your Exact Market Answers.

Start your 7-day free trial.