Manufactured Housing and the Rural Small-Balance Mortgage Market

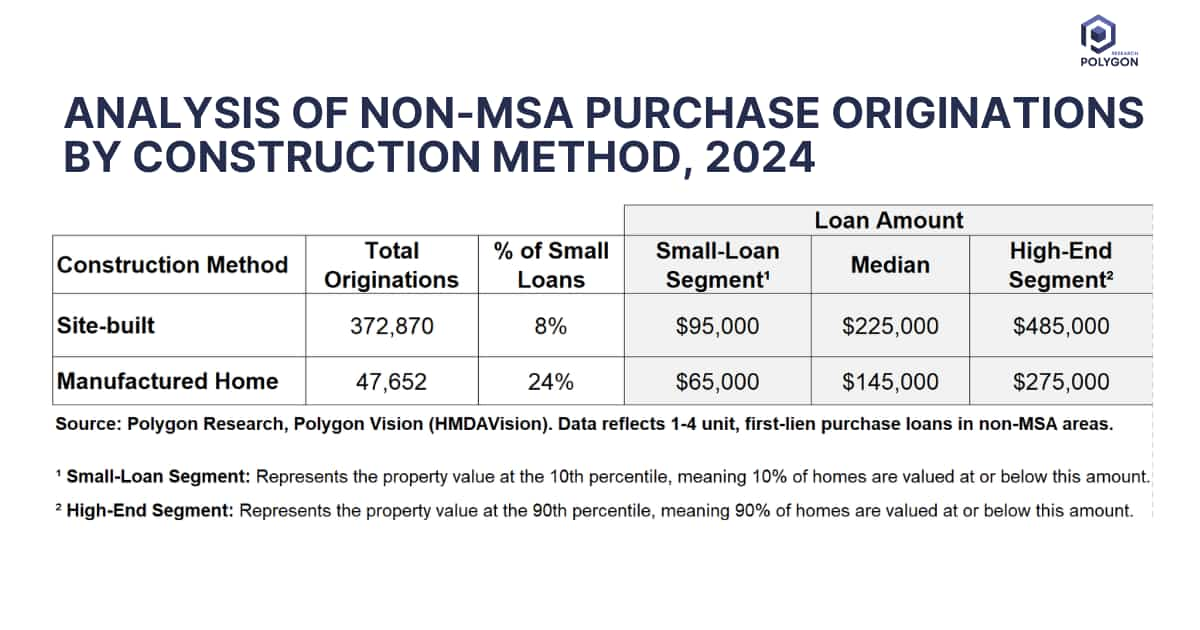

This analysis offers a more complete picture of the non-MSA purchase market by examining the distribution of loan amounts, rather than relying on a single average. By showing the median alongside the ‘Small-Loan’ and ‘High-End’ segments, the data reveals the fundamentally different market structures for site-built and manufactured homes in rural communities.

The data shows manufactured home mortgages are significantly smaller, with a median loan amount ($145,000) that is $80,000 less than for site-built homes ($225,000). This distinction is most pronounced in the ‘Small-Loan Segment,’ defined as the bottom 10% of originated loan amounts. A full 24% of manufactured home mortgages fall into this category, compared to just 8% for site-built.

For lenders, this data reinforces that any strategy for serving non-metro areas must address the unique dynamics of manufactured housing. The small-loan market is notoriously challenging due to fixed origination costs, but it's a vital pathway to homeownership in these regions.

Focusing on operational efficiencies for smaller-balance manufactured home loans is a direct strategy to serve these communities and meet affordable housing goals.

From Analysis to Action

Ready to Continue? Get Your Exact Market Answers.

Start your 7-day free trial.