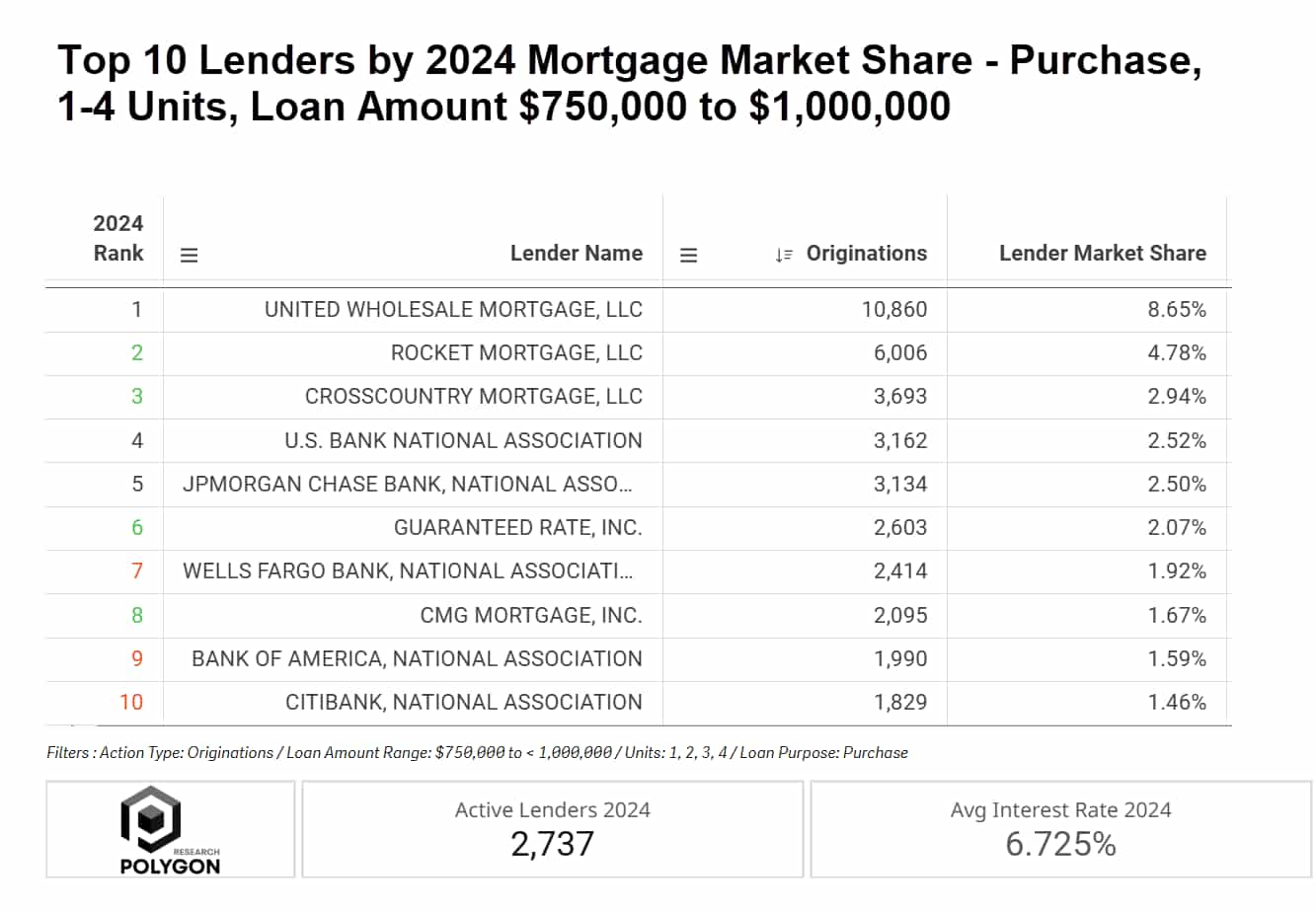

Mortgage Purchase Market Share for Loans $750K - $1M

This table offers a focused snapshot of a very specific mortgage market segment: home purchase loans for 1-4 unit properties, with loan amounts between $750,000 and $1,000,000. By narrowing the focus, we can see a different set of leaders and understand their strategy.

- For large national banks, it emphasizes leveraging brand recognition and capital to defend their position against both traditional and non-bank rivals.

- For smaller regional banks, credit unions, and independent mortgage bankers, the data suggests that a direct volume-based competition is not the only path to success. A more effective approach may involve developing a niche strategy focused on building strong local relationships, delivering exceptional customer service, or offering specialized loan products.

There are 2,737 lenders that lend in this loan size segment but the top 10 control about 30% of this loan segment, and everyone else competes for the rest 70%. Success in this space comes from owning a niche. A smaller lender can be the absolute best at one thing - perhaps complex self-employed borrower loans, unique property types, or providing a high-touch, personal service that can't be automated.

It's essential to "know where you stand," not in the vast ocean, but in your specific pond.

From Analysis to Action

Ready to Continue? Get Your Exact Market Answers.

Start your 7-day free trial.