Data Privacy Week offers a good moment to step back and think about how we gather information to grow our mortgage businesses.

Over the past few years, there has been a noticeable shift in how consumer data is regulated and discussed — from trigger leads being phased out to broader conversations about data monetization in financial services. For mortgage professionals who rely on data to make sound business decisions, this is an opportunity to reassess which strategies are both effective and sustainable.

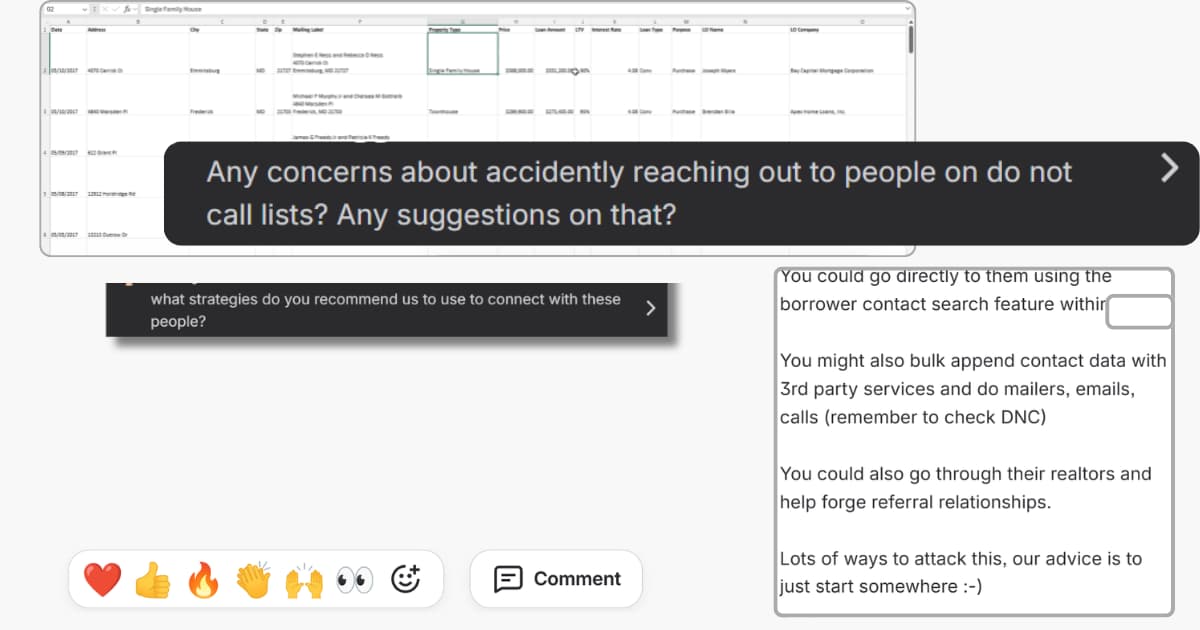

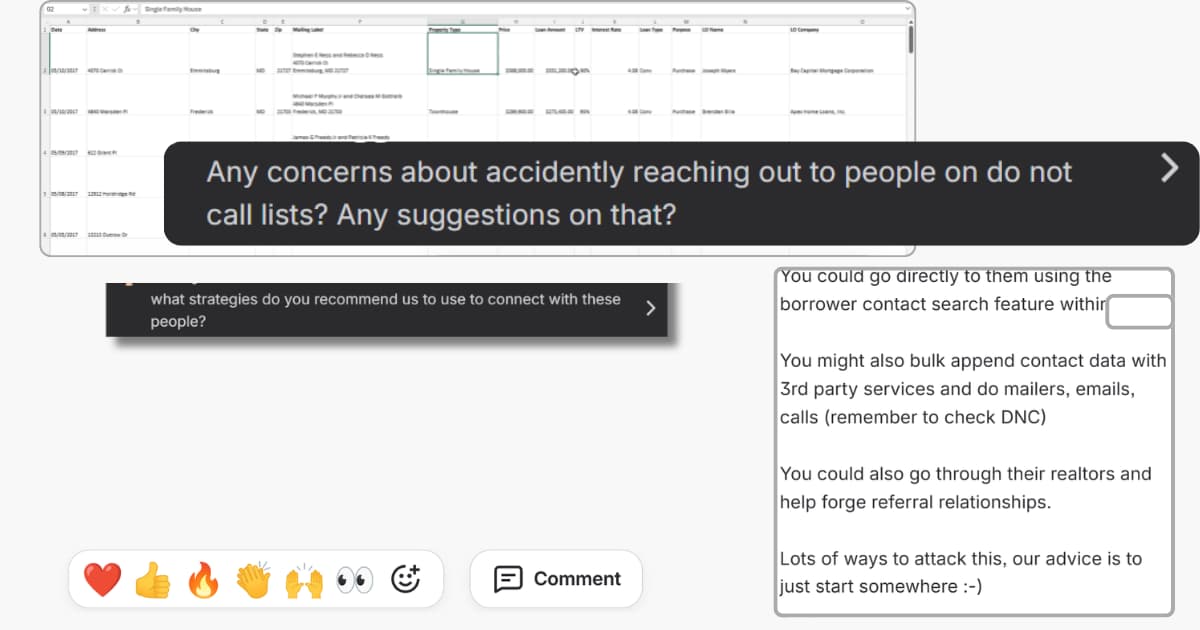

Recently, I watched a demo of one of the many mortgage marketing solutions out there.

What stood out wasn’t the product features. It was the audience’s questions:

“Is this compliant?”

“Do we have permission to contact these people?”

When the first questions focus on privacy and consent, it suggests something deeper. Even users of these tools sense that parts of the system operate in a gray area. When compliance dominates the conversation, it may be time to reconsider the underlying approach.

Most mortgage professionals ultimately take one of two paths when it comes to using data for growth.

One path focuses on individual targeting. It starts with public property records such as date of transaction, address, buyer (borrower)/seller name, address, loan amount, loan type, interest rate, lender and possibly MLO name; and then appends private contact information — phone numbers, email addresses, mobile numbers — obtained through third-party data brokers. The result is a list of “reachable” borrowers. This path is also called "data aggregation and enrichment."

The other path focuses on mortgage market intelligence. Instead of building contact lists, it analyzes transaction patterns, borrower segments, product trends, and geographic dynamics to understand where opportunity is forming.

Both approaches rely on public or open records. But they treat them very differently.

Property records serve a clear public purpose: documenting ownership, liens, and legal interests in real estate. They were never designed to function as marketing opt-ins.

In many marketing systems, those records are transformed. Names and addresses are matched with additionally sourced phone numbers and email addresses. Public information becomes a foundation for individualized outreach.

This practice sits in an increasingly gray area.

While property records are public, personal contact information is not. Combining the two creates detailed consumer profiles that most borrowers never knowingly consented to. From our perspective, this crosses an important ethical and strategic line — even when it may technically be permissible.

More importantly, it introduces risk and uncertainty into business development strategies.

If your prospecting depends on public records with appended personal contact information, it is worth examining how that system performs in practice.

First, there is timing. Public records reflect completed transactions. By the time a refinance or purchase appears, the borrower has already selected a lender. Outreach happens after the decision has been made.

Second, there is visibility. These records only capture people who have already transacted. First-time buyers, renters preparing to purchase, relocating households, and future move-up buyers remain largely invisible.

Third, there is cost. Subscription fees, data appending charges, CRM management, compliance monitoring, and cold outreach all add up. The time spent managing lists is time not spent developing relationships. There is the illusion that these type of "mortgage intelligence" saves time and costs.

Finally, there is risk. Attaching private contact information to public records and using it for mass outreach continues to face regulatory, legal, and reputational scrutiny. Building long-term growth on practices that may tighten further deserves careful consideration. In a few weeks, in March 2026, trigger leads ban will be in effect limiting the practice even further.

Mortgage market intelligence takes a different approach.

Instead of asking, “Who can I contact?” it asks, “What is happening in my market?”, "Why?" and "How?".

It helps lenders understand where activity is increasing, which loan products are gaining traction, how borrower segments are shifting, and how competition is evolving across neighborhoods and price ranges. It allows lenders to glean the choices their borrowers make - for example, Borrower Shopping Index (BSI), is a measure that allows you to analyze to what degree borrowers shop for their mortgage, and compare your BSI to your peers or competitors in the market segment of your choice). Having access to such deep insights allows you to adjust your strategy.

This information is forward-looking. It reveals emerging patterns rather than completed transactions.

→ Read our whitepaper on credit unions and young borrowers

Suppose your market analysis shows that refinance activity has increased 35% in three ZIP codes over the past quarter.

A contact-list approach gives you names of borrowers who already refinanced. It does not give you insight into the nature of the refinance - rate and term or cash-out refinance?

Market intelligence shows you something deeper: rising cash-out volume, increasing loan amounts, growth in adjustable-rate products, activity concentrated in $600K–$800K homes, and borrowers who purchased five to seven years ago and are renovating.

Now you can prepare relevant expertise, work with realtors serving those neighborhoods, partner with contractors, and identify similar households before they transact.

One approach provides names.

The other provides context and strategy.

When you understand your market at this level, you are no longer dependent on purchased data.

You develop institutional knowledge.

You can advise partners intelligently. You can anticipate borrower needs. You become known for insight rather than outreach volume. Referrals and repeat business follow naturally.

Tools like HMDAVision and CensusVision, part of Polygon Vision, and Polygon Pulse power instant deep mortgage market intelligence.

This approach is easy with Polygon Research tools, but it naturally takes longer to build than buying lists. But it compounds over time.

Deep market understanding supports better relationships.

It allows you to have meaningful conversations with realtors, provide useful insights to builders, engage community organizations, and support borrowers before they enter formal application processes.

Growth built on trust is more resilient than growth built on interruption.

This philosophy shapes how we build Polygon Research.

We focus on open and regulatory data sources to deliver mortgage market intelligence:

We do not build products around attaching private contact information to public records.

We believe institutions perform better when they understand markets rather than chase individuals.

As you reflect on your own strategy, it may be useful to ask:

Data Privacy Day is not only about compliance. It is about long-term strategy.

The mortgage professionals who thrive in the coming decade are unlikely to be those who mastered data aggregation. They will be those who mastered market understanding, built genuine partnerships, and positioned themselves where opportunity was developing.

Both paths remain available.

The question is which foundation you want to build on.

Discover how Polygon Research supports relationship-driven growth through market intelligence to drive your success.

Why appending borrower phone/email to public records is risky—and how mortgage market intelligence helps lenders grow through market insight and trust.

Data Privacy Week offers a good moment to step back and think about how we gather information to grow our mortgage businesses.

Over the past few years, there has been a noticeable shift in how consumer data is regulated and discussed — from trigger leads being phased out to broader conversations about data monetization in financial services. For mortgage professionals who rely on data to make sound business decisions, this is an opportunity to reassess which strategies are both effective and sustainable.

Recently, I watched a demo of one of the many mortgage marketing solutions out there.

What stood out wasn’t the product features. It was the audience’s questions:

“Is this compliant?”

“Do we have permission to contact these people?”

When the first questions focus on privacy and consent, it suggests something deeper. Even users of these tools sense that parts of the system operate in a gray area. When compliance dominates the conversation, it may be time to reconsider the underlying approach.

Most mortgage professionals ultimately take one of two paths when it comes to using data for growth.

One path focuses on individual targeting. It starts with public property records such as date of transaction, address, buyer (borrower)/seller name, address, loan amount, loan type, interest rate, lender and possibly MLO name; and then appends private contact information — phone numbers, email addresses, mobile numbers — obtained through third-party data brokers. The result is a list of “reachable” borrowers. This path is also called "data aggregation and enrichment."

The other path focuses on mortgage market intelligence. Instead of building contact lists, it analyzes transaction patterns, borrower segments, product trends, and geographic dynamics to understand where opportunity is forming.

Both approaches rely on public or open records. But they treat them very differently.

Property records serve a clear public purpose: documenting ownership, liens, and legal interests in real estate. They were never designed to function as marketing opt-ins.

In many marketing systems, those records are transformed. Names and addresses are matched with additionally sourced phone numbers and email addresses. Public information becomes a foundation for individualized outreach.

This practice sits in an increasingly gray area.

While property records are public, personal contact information is not. Combining the two creates detailed consumer profiles that most borrowers never knowingly consented to. From our perspective, this crosses an important ethical and strategic line — even when it may technically be permissible.

More importantly, it introduces risk and uncertainty into business development strategies.

If your prospecting depends on public records with appended personal contact information, it is worth examining how that system performs in practice.

First, there is timing. Public records reflect completed transactions. By the time a refinance or purchase appears, the borrower has already selected a lender. Outreach happens after the decision has been made.

Second, there is visibility. These records only capture people who have already transacted. First-time buyers, renters preparing to purchase, relocating households, and future move-up buyers remain largely invisible.

Third, there is cost. Subscription fees, data appending charges, CRM management, compliance monitoring, and cold outreach all add up. The time spent managing lists is time not spent developing relationships. There is the illusion that these type of "mortgage intelligence" saves time and costs.

Finally, there is risk. Attaching private contact information to public records and using it for mass outreach continues to face regulatory, legal, and reputational scrutiny. Building long-term growth on practices that may tighten further deserves careful consideration. In a few weeks, in March 2026, trigger leads ban will be in effect limiting the practice even further.

Mortgage market intelligence takes a different approach.

Instead of asking, “Who can I contact?” it asks, “What is happening in my market?”, "Why?" and "How?".

It helps lenders understand where activity is increasing, which loan products are gaining traction, how borrower segments are shifting, and how competition is evolving across neighborhoods and price ranges. It allows lenders to glean the choices their borrowers make - for example, Borrower Shopping Index (BSI), is a measure that allows you to analyze to what degree borrowers shop for their mortgage, and compare your BSI to your peers or competitors in the market segment of your choice). Having access to such deep insights allows you to adjust your strategy.

This information is forward-looking. It reveals emerging patterns rather than completed transactions.

→ Read our whitepaper on credit unions and young borrowers

Suppose your market analysis shows that refinance activity has increased 35% in three ZIP codes over the past quarter.

A contact-list approach gives you names of borrowers who already refinanced. It does not give you insight into the nature of the refinance - rate and term or cash-out refinance?

Market intelligence shows you something deeper: rising cash-out volume, increasing loan amounts, growth in adjustable-rate products, activity concentrated in $600K–$800K homes, and borrowers who purchased five to seven years ago and are renovating.

Now you can prepare relevant expertise, work with realtors serving those neighborhoods, partner with contractors, and identify similar households before they transact.

One approach provides names.

The other provides context and strategy.

When you understand your market at this level, you are no longer dependent on purchased data.

You develop institutional knowledge.

You can advise partners intelligently. You can anticipate borrower needs. You become known for insight rather than outreach volume. Referrals and repeat business follow naturally.

Tools like HMDAVision and CensusVision, part of Polygon Vision, and Polygon Pulse power instant deep mortgage market intelligence.

This approach is easy with Polygon Research tools, but it naturally takes longer to build than buying lists. But it compounds over time.

Deep market understanding supports better relationships.

It allows you to have meaningful conversations with realtors, provide useful insights to builders, engage community organizations, and support borrowers before they enter formal application processes.

Growth built on trust is more resilient than growth built on interruption.

This philosophy shapes how we build Polygon Research.

We focus on open and regulatory data sources to deliver mortgage market intelligence:

We do not build products around attaching private contact information to public records.

We believe institutions perform better when they understand markets rather than chase individuals.

As you reflect on your own strategy, it may be useful to ask:

Data Privacy Day is not only about compliance. It is about long-term strategy.

The mortgage professionals who thrive in the coming decade are unlikely to be those who mastered data aggregation. They will be those who mastered market understanding, built genuine partnerships, and positioned themselves where opportunity was developing.

Both paths remain available.

The question is which foundation you want to build on.

Discover how Polygon Research supports relationship-driven growth through market intelligence to drive your success.